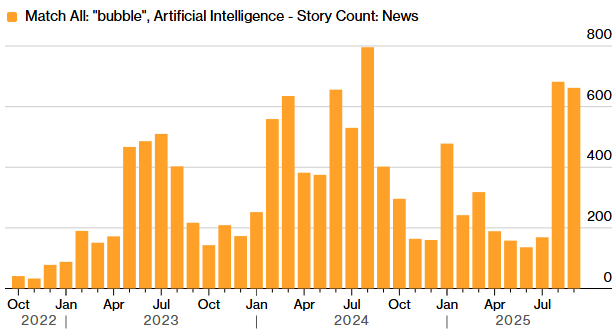

An AI crash would resemble a hybrid of the 1990s dot-com bust and the 2008 financial crisis—but centered around artificial intelligence infrastructure, data centers, and corporate overinvestment. It would likely begin as a sudden market correction in overvalued AI firms and GPU suppliers, then spread through the financial system and tech economy as debt and demand collapse.

Market and Investment Collapse

In early stages, overleveraged companies like OpenAI, Anthropic, or firms heavily reliant on GPU compute (e.g., Nvidia, Oracle, Microsoft) would face sharp valuation drops as AI-generated revenues fail to justify trillion-dollar capital expenditures. Investor panic could trigger a chain reaction, collapsing the leveraged network of data‑center finance. Bloomberg and the Bank of England have both warned of a “sudden correction” and circular investing between chip firms and hyperscalers that artificially props up earnings.transformernews+1

The Data Center Bust

According to historian Margaret O’Mara and business analyst Shane Greenstein, AI data centers—many purpose‑built for model training using GPUs—are highly specialized and often remote from urban demand. These centers might last only 3–5 years and have little reuse value outside AI or crypto mining. If capital inflows freeze, thousands of megawatts of compute could become stranded assets, comparable to the empty fiber networks after the dot‑com collapse.transformernews

Economic Impact

The International Monetary Fund estimates roughly a third of current US GDP growth depends on AI-related investment. If the bubble bursts, consumption could fall from loss of “AI wealth effects,” dragging global markets into recession. Analysts at Transformer News liken it to Britain’s 1840s railway mania: vast sums invested in technology that ultimately enriched the future economy—at the cost of investors’ ruin.globalcapital+2

Consequences for Jobs and Technology

For the workforce, the crash would begin with mass layoffs across the tech sector and data‑center construction, followed by second‑order layoffs in software, marketing, and education technology. However, as with the post‑dot‑com era, redundant talent and abandoned infrastructure could later fuel a new, leaner AI industry based on sustainable business models.reddit+2

Systemic and Political Risks

While the contagion risk is smaller than subprime mortgages in 2008, debt-financed AI expansion—Oracle’s $100 billion borrowing plan with OpenAI being one example—creates vulnerability for lenders and investors. Should a major firm default, cascading insolvencies could ripple through the supply chain, forcing governments to intervene. Some analysts expect this crash would prompt stricter AI regulation and financing guardrails reminiscent of those enacted after the Great Depression.transformernews

Long-Term View

If artificial general intelligence (AGI) does eventually deliver major productivity gains, early investments may appear prescient. But if not, a 2020s AI crash would leave disused GPU campuses and massive debt—an exuberant experiment that accelerated technological progress at ruinous human cost.unherd+2

Which industries would collapse first in an AI crash

In the event of an AI crash, several sectors would be hit first and hardest — especially those that have overexpanded based on speculative expectations of AI-driven profits or infrastructure demand. The collapse would cascade through high-capex industries, ripple across financial services, and disrupt employment-dependent consumer sectors.

Semiconductor and GPU Manufacturing

The semiconductor industry would be the first to collapse due to its heavy dependence on AI demand. Data center GPUs currently drive over 90% of Nvidia’s server revenue, and the entire sector’s value nearly doubled between 2024 and 2025 based on AI compute growth forecasts. If hyperscaler demand dries up, the oversupply of GPUs, high-bandwidth memory (HBM), and AI ASICs could cause a price crash similar to the telecom equipment bust in 2002. Chip makers and startups like Groq, Cerebras, and Tenstorrent—heavily leveraged to AI workloads—would struggle to survive the sudden capital freeze.digitalisationworld

Cloud and Data Center Infrastructure

AI-heavy cloud providers such as Microsoft Azure, AWS, Google Cloud, and Oracle Cloud would see massive write-downs in data center assets. Overbuilt hyperscale and sovereign AI campuses could become stranded investments worth billions as training workloads decline and electricity costs remain high. This dynamic mirrors the way dark fiber networks from the 1990s dot-com era lay idle for years after overinvestment.digitalisationworld

Digital Advertising and Marketing

The advertising and media sector—already experiencing erosion due to AI‑generated content—would decline abruptly. Companies like WPP have already lost 50% of their stock value in 2025 due to automated ad-generation technologies cannibalizing human creative work. As AI content generation saturates the market, profit margins in marketing, online publishing, and synthetic media platforms like Shutterstock and Wix could collapse.ainvest

Financial and Staffing Services

Financial services and staffing firms are another early casualty. AI has already automated large portions of transaction processing, compliance, and manual recruitment. Firms such as ManpowerGroup and Robert Half have reportedly seen 30–50% market value declines due to these pressures. In an AI crash, their exposure to risk-laden corporate clients and shrinking demand for human labor matching would deepen losses, while regulators tighten AI governance in compliance-heavy finance.ainvest

Transportation and Logistics

The transportation and logistics sector, closely tied to AI investment through autonomous systems, faces structural weakness. Millions of driving and delivery jobs could disappear due to automation, but the firms funding autonomous fleets—such as Tesla Freight and Aurora Innovations—would hemorrhage cash if capital dries up before widespread profitability. AI‑powered routing and warehouse systems could be written down as expensive overcapacity.ainvest

Secondary Collapse: Retail and Customer Support

Finally, customer‑facing retail and support sectors would be heavily affected. With AI chatbots now handling about 80% of common queries, these labor markets are already contracting. A market shock would worsen layoffs while eroding spending power, compounding the downturn.ainvest

Summary Table

| Industry | Collapse Trigger | First-Order Impact | Example Companies Affected |

|---|---|---|---|

| Semiconductors | GPU oversupply, hyperscaler pullback | Revenue crashes, fab overcapacity | Nvidia, AMD, TSMC, Cerebras digitalisationworld |

| Cloud & Data Centers | Halt in AI training spend | Idle assets, megacenter write-downs | Microsoft, AWS, Oracle Cloud digitalisationworld |

| Advertising & Media | Automated ad content cannibalization | Loss of billable creative work | WPP, Shutterstock, Wix ainvest |

| Financial & Staffing | Job automation, credit exposure | Rapid fall in client demand, defaults | ManpowerGroup, Robert Half ainvest |

| Transportation | Delay in autonomous projects | Job losses, asset devaluation | Tesla Freight, Aurora, Waymo ainvest |

| Retail & Support | Customer service automation | Widespread workforce reduction | Shopify, Zendesk ainvest |

In short, the first phase of an AI crash would decimate GPU suppliers and infrastructure providers, followed by cascading losses in services and labor markets that relied on sustained AI adoption and speculative investor optimism.

The Hyperscalers who would be most affected in an AI crash

The hyperscalers most severely affected by an AI crash would be those that have sunk the largest capital into AI‑specific data center expansion without commensurate returns—primarily Microsoft, Amazon (AWS), Alphabet (Google Cloud), Meta, Oracle, and to a lesser extent GPU‑specialist partners like CoreWeave and Crusoe Energy Systems. These companies are deep in an investment cycle driven by trillion‑dollar valuations and multi‑gigawatt data center commitments, meaning a downturn would cripple balance sheets, strand assets, and force major write‑downs.

Microsoft

Microsoft is the hyperscaler most exposed to an AI collapse. It has committed $80 billion for fiscal 2025 to AI‑optimized data centers, largely to support OpenAI’s model training workloads on Azure. Over half this investment is in the U.S., focusing on high‑power, GPU‑dense facilities that may become stranded if demand for model training plunges. The company also co‑leads multi‑partner mega‑projects like Stargate, a $500 billion AI campus venture involving SoftBank and Oracle.ft+1

Amazon Web Services (AWS)

AWS is next in risk magnitude, with $86 billion in active AI infrastructure commitments spanning Indiana, Virginia, and Frankfurt. Many of its new campuses are dedicated to AI‑as‑a‑Service workloads and custom silicon (Trainium, Inferentia). If model‑training customers scale back, AWS faces overcapacity in power‑hungry clusters designed for sustained maximum utilization. Analysts warn that such facilities are difficult to repurpose for general cloud usage due to 10× higher rack power and cooling loads.thenetworkinstallers+1

Alphabet (Google Cloud)

Google’s parent company, Alphabet, has pledged around $75 billion in AI infrastructure spending in 2025 alone—heavily concentrated in server farms for Gemini model operations. The company’s shift to AI‑dense GPU clusters has already required ripping and rebuilding sites mid‑construction. In a crash, Alphabet’s reliance on advertising to subsidize capex would expose it to compounding financial stress.ft+1

Meta

Meta’s risk is driven by scale and ambition rather than cloud dependency. The company is investing $60–65 billion into a network of AI superclusters, including a 2 GW data center in Louisiana designed purely for model training. Mark Zuckerberg’s goal to reach “superintelligence” entails constant full‑load operation—meaning unused compute in a recession would yield enormous sunk‑cost losses.hanwhadatacenters+1

Oracle

Oracle, a late entrant to the hyperscaler race, ranks as the fourth largest hyperscaler and has become deeply tied to OpenAI’s infrastructure build. It is reportedly providing 400,000 Nvidia GPUs—worth about $40 billion—for OpenAI’s Texas and UAE campuses under the Stargate project. Oracle’s dependency on a few high‑risk customers makes it vulnerable to disproportionate collapse if those clients cut capital expenditures.ft

GPU Cloud Specialists (CoreWeave, Crusoe, Lambda)

Although smaller in scale, CoreWeave, Crusoe Energy Systems, and Lambda Labs face acute financial danger. Each is highly leveraged to GPU leasing economics that assume near‑continuous utilization. A pause in large‑model training would break their cash flow structure, causing defaults among the so‑called “neo‑cloud” providers.hanwhadatacenters

Comparative Exposure Overview

| Hyperscaler | Estimated 2025 AI Capex | Primary Risk Channel | Vulnerability in a Crash |

|---|---|---|---|

| Microsoft | $80 billion | Overexposure to OpenAI workloads | Extremely high hanwhadatacenters |

| Amazon (AWS) | $86 billion | Idle compute, train‑specific sites | Very high thenetworkinstallers |

| Alphabet | $75 billion | Advertising decline + AI site overbuild | High thenetworkinstallers |

| Meta | $60–65 billion | Pure AI data center utilization risk | High hanwhadatacenters |

| Oracle | $40 billion (via Stargate) | Concentrated tenant risk (OpenAI) | Very high ft |

| CoreWeave / Crusoe / Lambda | $10–15 billion range | Debt leverage and GPU lease dependence | Extreme hanwhadatacenters |

Summary

A sustained AI market collapse would first hit these hyperscalers through GPU underutilization, stranded data‑center capacity, and debt‑heavy infrastructure financing. Microsoft, Oracle, and Meta would face the most immediate write‑downs given their recent megaproject commitments. Amazon and Google, while financially stronger, would absorb heavy revenue compression. Specialized GPU‑cloud providers—CoreWeave, Crusoe, and Lambda—could fail outright due to funding constraints and dependence on short‑term AI demand surges.thenetworkinstallers+2